Ep. 301 Max Borders on UNDERthrowing Tyrannical Regimes

Max Borders is Executive Director of Social Evolution. He has a freewheeling discussion with Bob on UNDERthrowing–rather than overthrowing–unjust regimes. Mentioned in the Episode and Other Links of Interest: The YouTube version of this interview. Max Borders’ organization, Social Evolution. Max’s Medium archive. Jordan Peterson’s closing speech at ARC. Help support the Bob Murphy Show.

Ep. 300 David Gornoski on how the Israel/Hamas Propaganda War Shows Triumph of Christ

David Gornoski uses Rene Girard’s mimetic framework to show how the modern world has been transformed by the Christian account. He applies it in this discussion to the propaganda war in the Middle East. Mentioned in the Episode and Other Links of Interest: David Gornoski’s WND article on the topic. Gornoski’s show, A Neighbor’s Choice.…

Ep. 299 Bob Murphy Critiques 3 MMT Talking Points

Bob goes solo to explain and critique three popular arguments put forward by the leaders of Modern Monetary Theory (MMT). Mentioned in the Episode and Other Links of Interest: Phil Labonte’s reaction to Nina Turner. A Murphy Medium post showcasing Kelton’s claim about checking vs. savings accounts. Bob’s review of Kelton’s book, The Deficit Myth.…

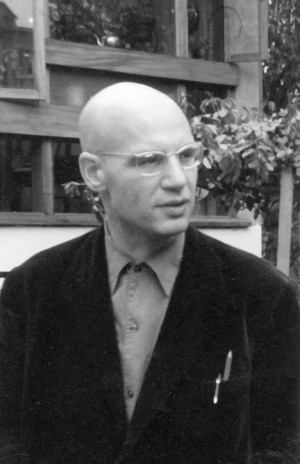

Ep. 298 Steve Landsburg on the Math Genius Grothendieck

Steve joins Bob to discuss the life and revolutionary approach to mathematicians of Alexander Grothendieck. Mentioned in the Episode and Other Links of Interest: The YouTube version of this interview. Steve’s blog post and here on Grothendieck. Steve’s list of articles referencing Grothendieck. Steve’s books. Steve’s previous appearance on the BMS. Help support the Bob Murphy Show.

Ep. 297 Dan Sanchez on Keeping the Faith Through Sickness, and Spreading Economic Education

Dan Sanchez is Director of Content at the Foundation for Economic Education (FEE). He explains some of FEE’s new initiatives to teach free-market economics, but he first details his recently diagnosed medical condition and how his faith has been carrying him through the ordeal. Mentioned in the Episode and Other Links of Interest: The YouTube…