Ep. 291 Douglas Robert Uses MMT to Challenge Bob’s Recession Call

Douglas Robert is a recovering Austrian who subscribes to the MMT framework as being the most useful for trading. He has a friendly debate with Bob over the inverted yield curve and whether a recession is at hand. Mentioned in the Episode and Other Links of Interest: The YouTube version of this interview. Douglas Robert’s…

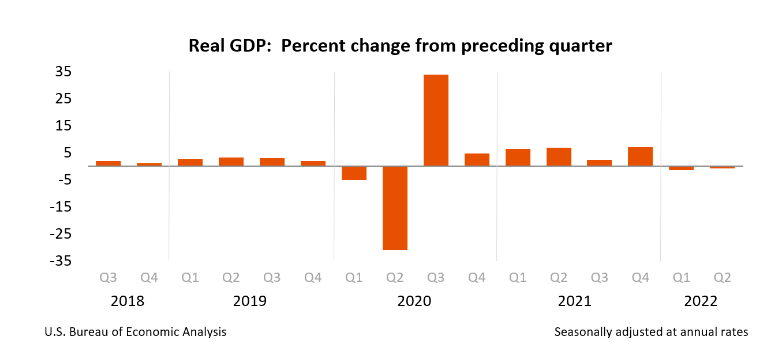

Ep. 246 Tim Pool on Labor Migration and Are We in a Recession?

Bob first pushes back on Tim Pool’s recent commentary on interstate labor mobility, then turns to address whether the US is currently in a recession. He explains the role that inventories play in conventional GDP accounting. Mentioned in the Episode and Other Links of Interest: The YouTube source of the Tim Pool clip. Bob’s article…

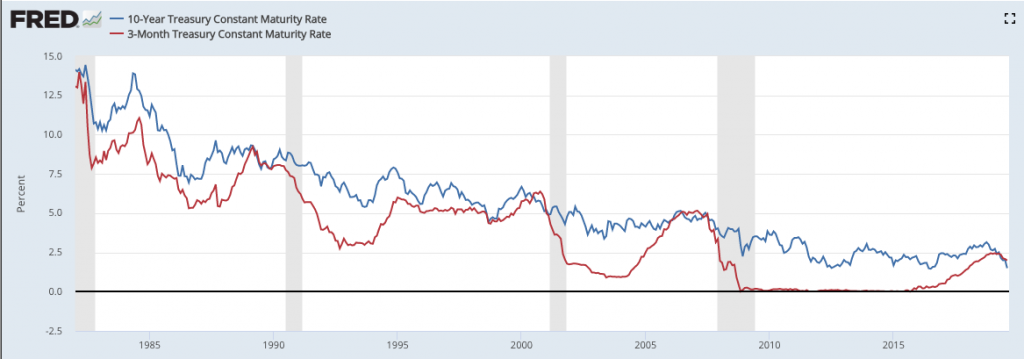

Ep. 242 Thoughts on the Libertarian National Convention, and Is the Fed Going to Cause a Recession?

Bob offers thoughts on the LP Mises Caucus takeover, Justin Amash’s speech, and then argues that the Fed has not yet begun to tighten. Mentioned in the Episode and Other Links of Interest: Justin Amash’s quotes from Mises at LNC 2022. Bob’s book on Understanding Money Mechanics, and the chapter on the yield curve. Bob’s…

Ep. 56 Bob Murphy Explains Austrian Business Cycle Theory, the Inverted Yield Curve, and the Coming Recession

Bob goes solo to give a quick explanation of the Mises-Hayek theory of the boom-bust cycle, and how he used it to forecast the financial crisis in 2008 a year ahead of time. He then explains the significance of an “inverted yield curve,” and shows how the Austrians can understand its predictive power much better…