Ep. 175 David Andolfatto Defends the Fed

Ron Paul used the fall in purchasing power since the founding of the Fed to argue that the central bank had hurt regular Americans. Fed economist David Andolfatto disagrees, but Bob pushes back. Mentioned in the Episode and Other Links of Interest: The YouTube version of this interview. David Andolfatto critiques Ron Paul’s argument against the…

Ep. 150 Explaining the Plan to Dismantle Schools and the Fed’s Alchemy

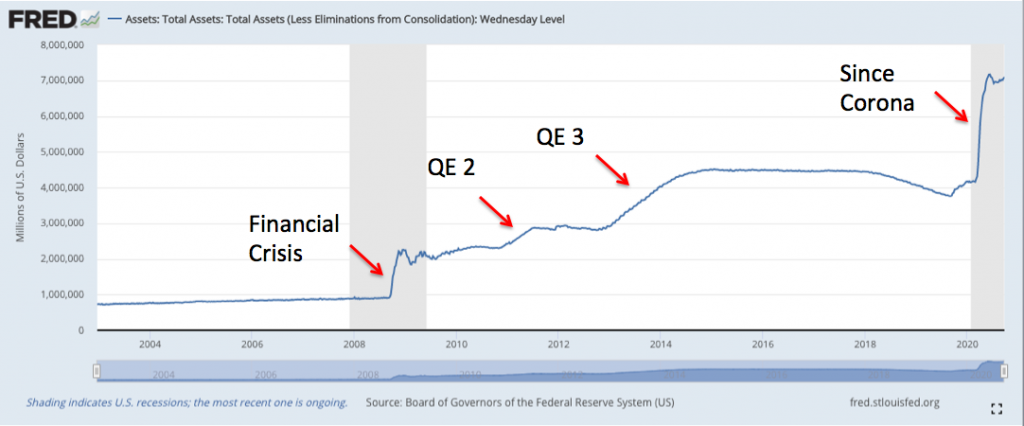

Bob reads from an article recently tweeted out by the NEA, which calls for an end to schooling as we know it in order to promote anti-racism. He then discusses what the Fed has been up to since the coronavirus panic began. Mentioned in the Episode and Other Links of Interest: The YouTube version of this episode…

Ep. 112 Commentary on the Politics and Economics of the Coronavirus Response

Bob comments on various aspects of the response to the coronavirus. Although many libertarians are accusing the authorities of exaggerating the threat, it would also be a “libertarian take” to accuse them of downplaying the threat early on, misleading the public on how to stay safe. Bob also tries to clarify thinking about the Fed’s…

Ep. 68 Jeff Snider Explains the Repo Market Flare-Up, the Fed’s Phony Solution, and the Global Dollar Problem

Jeff Snider is Head of Global Research at Alhambra Investments. He talks with Bob about the recent spike in lending rates in the repo markets, and how the Fed’s attempted solution fails to address the real problem. He then relates the repo problem to the global monetary system, which has suffered from major imbalances going…

Ep. 10 This One Simple Fed Trick Earns the Bankers Billions

Bob flies solo to explain what he means when he tells crowds, “Back in the fall of 2008, as the financial crisis hit, the Fed began paying banks to not make loans to their customers.” Specifically, Bob explains the new Fed procedure of “paying interest on reserve balances.” As of the Fed’s December 2018 meeting,…