Ep. 266 Does Government Debt Benefit Society?

Bob takes a David Andolfatto tweet to explain why it’s wrong to think that issuing US Treasuries somehow creates social benefits. Then he rehashes a conversation with Peter St. Onge about whether we should care if the central bank goes bankrupt. Mentioned in the Episode and Other Links of Interest: David Andolfatto on inflation and…

Ep. 264 Is the Fed Bailing Out the Banks

Bob first describes what happened with Silicon Valley Bank, and then explores whether the Fed’s new lending facility constitutes a bailout of the banks, and what the economic consequences are. Mentioned in the Episode and Other Links of Interest: An article on the SVB facts. Bob and Jeff Deist on SVB and 100% banking. Help…

Ep. 243 To Understand (Price) Inflation Then and Now, Follow the Money

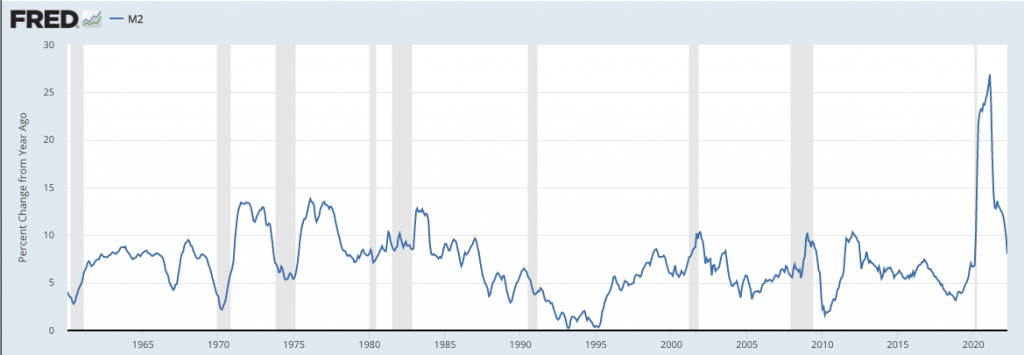

Bob seeks to explain why the Fed’s extraordinary monetary inflation following the 2008 financial crisis didn’t result in $5/gallon gasoline, while the Fed’s extraordinary monetary inflation following the 2020 coronavirus panic did. Mentioned in the Episode and Other Links of Interest: Bob’s newspaper op ed laying out his explanation. Bob’s blog post summarizing what happened…

Ep. 236 Jon Stewart Asks Great Questions of Federal Reserve Chief

In a recent episode of “The Problem With Jon Stewart,” the former Daily Show host asks former president of the Kansas City Fed Thomas Hoenig why the Fed couldn’t have bailed out homeowners, or just “quantitative ease” away the Treasury’s debt. Hoenig gives muddy answers, so Bob tries to clarify. Mentioned in the Episode and…

Ep. 217 Murphy Critiques MMT TED Talk

Bob provides a running refutation of Stephanie Kelton’s recent TED talk on Modern Monetary Theory (MMT). Mentioned in the Episode and Other Links of Interest: Stephanie Kelton’s TED Talk. Bob’s review of Kelton’s book explaining MMT. Kelton’s intro to MMT, The Deficit Myth. #Commissions Earned (As an Amazon Associate I earn from qualifying purchases.) Bob’s…