Ep. 67 Walter Block and William Barnett on Problems With the Hayekian Triangle

In a 2006 journal article, “On Hayekian Triangles,” Walter Block and William Barnett lists 14 separate objection to the popular device used (in various forms) by Hayek, Rothbard, and Roger Garrison to illustrate how artificially low interest rates lead to an unsustainable boom. Block concludes that the Hayekian triangle can be salvaged, while Barnett thinks…

Ep. 63 Nicolas Cachanosky on Improving Austrian Business Cycle Theory, the Dispute Over Fractional Reserve Banking, and How the Fed Broke Monetary Policy

Economist Nicolas Cachanosky specializes in the overlap between capital theory in traditional economics and the capitalization of cash flows in finance. He explains the relevance of these concepts to understanding the business cycle. Then Nicolas and Bob have a friendly disagreement over Mises’ views on fractional reserve banking. The conversation closes with Nicolas’ view on…

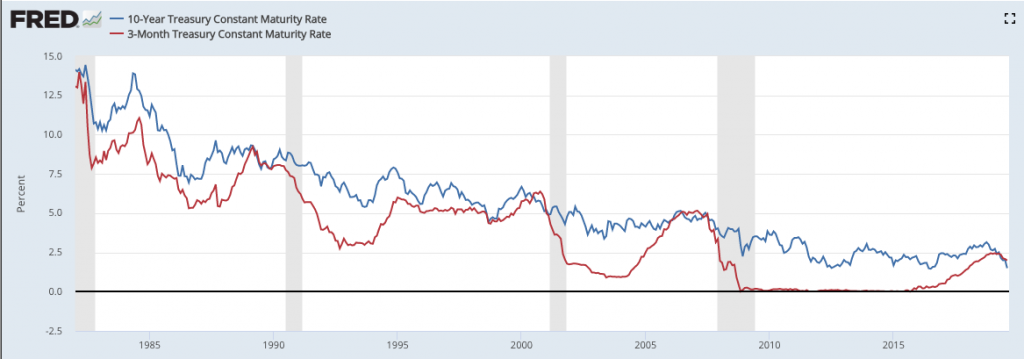

Ep. 56 Bob Murphy Explains Austrian Business Cycle Theory, the Inverted Yield Curve, and the Coming Recession

Bob goes solo to give a quick explanation of the Mises-Hayek theory of the boom-bust cycle, and how he used it to forecast the financial crisis in 2008 a year ahead of time. He then explains the significance of an “inverted yield curve,” and shows how the Austrians can understand its predictive power much better…